The hidden value of your new product

You innovate to keep ahead of the competition. But do you understand what your customer perceives as valuable? Let’s review what all the possible sources of value are for B2B products and services (note I’ll refer to product below but it also applies for services and solutions). In my next blog, I’ll talk about ways to capture that value by innovating the value capture.

First off, you need to understand the baseline: what is the “next best alternative” the customer is going to use instead of your product. This could be a direct comparison (say a new formulation that works better than the old one), or more complex if the offer is considerably different. Either way you should have one or more baseline offers relevant to the customer that allow a comparison.

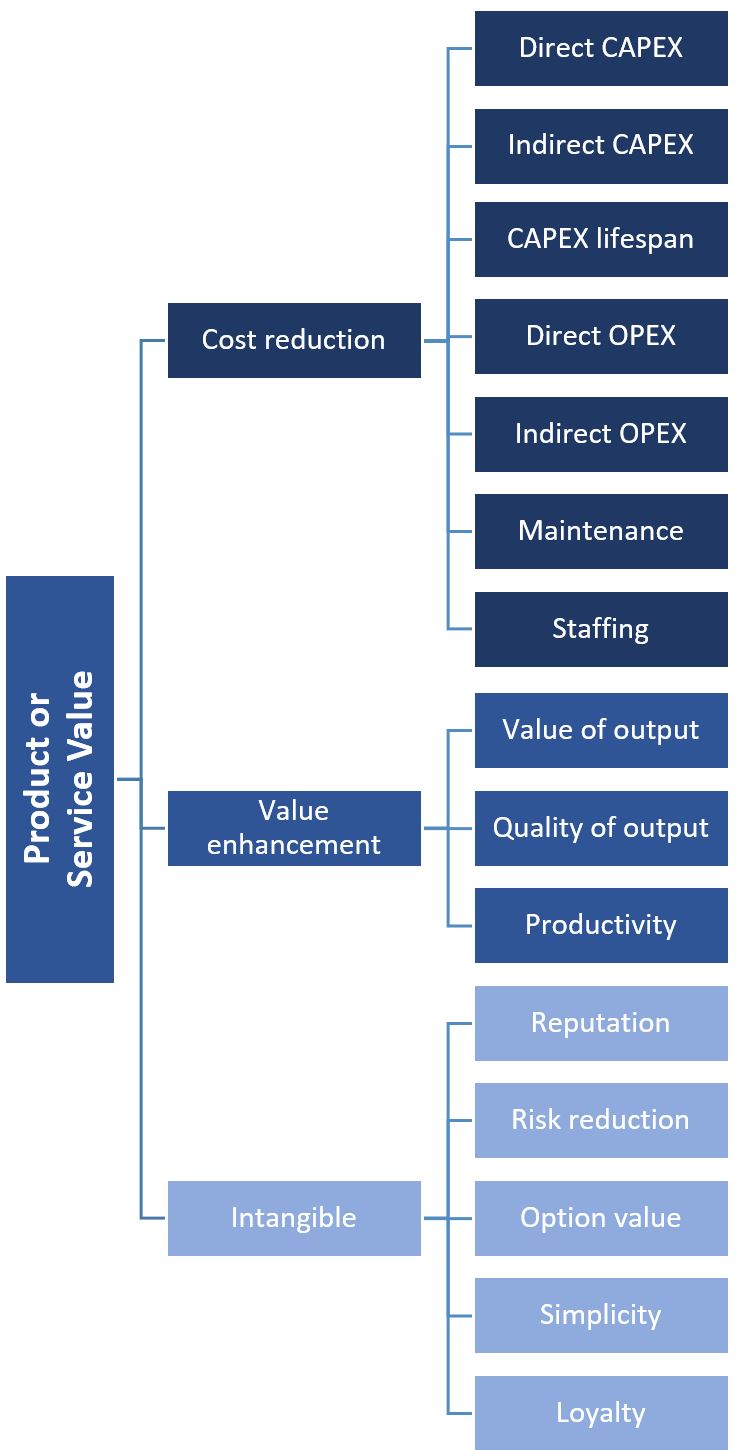

The three fundamental sources of value are:

- Cost reduction – lowering your customer’s costs

- Value enhancement – making their products more valuable for their customers

- Intangible – adding value in some other way

Let’s go through each of these in turn, keeping in mind that while the customer may perceive value-add with your product in some areas, it may be worse than the alternative in others (e.g. higher up-front prices or risks associated with making a change). These will be adoption barriers and need to be identified.

Cost Reduction: easy-peasy(-ish)

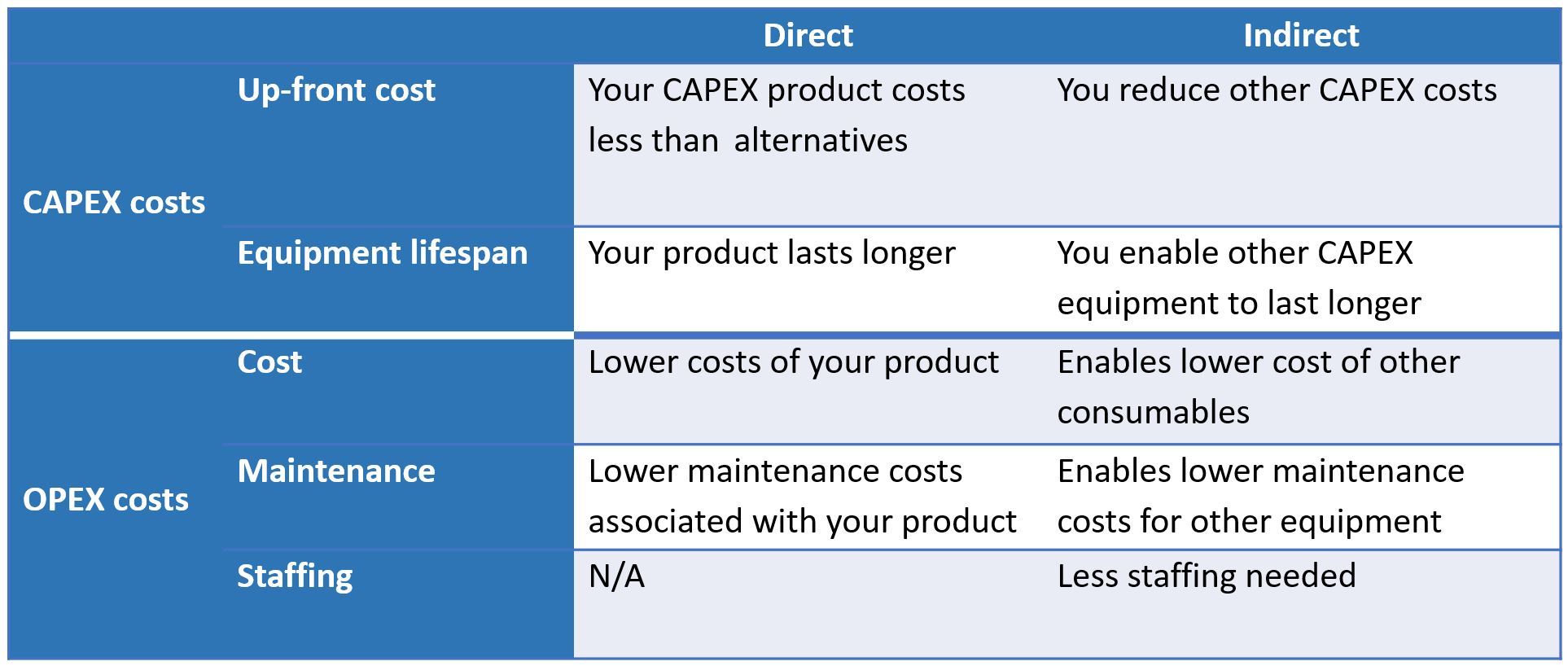

Cost reduction is in many ways the easiest of the three groups to estimate, but it also has multiple dimensions of potential value, including CAPEX and OPEX, direct and indirect, and sub-categories of these, best displayed in a table:

These can be modelled financially, giving a clear quantified benefit to the customer (assuming your assumptions are accurate). These types of benefits are the easiest to price in and justify.

One place to watch out: when your CAPEX product reduces an OPEX expense but at a higher price (solar power panels and related equipment for example), the higher up-front cost can be a barrier to adoption, especially due to the cash-flow impact and risk factors: a change to the pricing model may make sense.

Value Enhancement: trickier

There are three fundamental sources of value:

- Value of output – your product enhances the customer’s end-product value, allowing them to raise their prices

- Quality of output – improves consistency or quality specs of their product

- Productivity – eliminates or reduces a production bottleneck allowing for increased sales (particularly when capacity constrained)

These sources of value are harder to quantify, especially since your product value impacts your customer’s customer. This makes it harder capture as large a fraction of the value. Testing your value with customers to quantify it is most important here.

Intangible Value-Add: Hmmmm

The value here can be much more mysterious and difficult to price in, but by no means unimportant (brand value fits into this category).

Potential sources of value are:

- Reputation – enhances the value of the company (or individual) to use your products

- Risk reduction – reduces future risks

- Option value – creates options for future decisions that might not otherwise exist

- Simplicity – taking out complexity that will help operational effectiveness and efficiency

- Loyalty – making customers more loyal / extending customer value

All of these can potentially be quantified, but it’s usually impractical. And even customers may not understand this value well, so it can be hard to understand using market research. But don’t discount the value – just recognize that qualitative arguments will be needed more than quantitative.

(Note these all relate to a powerful framework for social threats and rewards: SCARF. It has broad implications on pricing tactics that I will review in a later blog.)

Uncovering the value

Although my focus has been on new products, the same analysis applies for your existing portfolio: are their hidden sources of value causing you to underprice?

The following process can uncover the value:

1. Brainstorm internally on the sources of value from your innovation. Grade them from +3 (very positive impact) to -3 (very negative impact), and include a rating of the confidence level of the grade. Do this for multiple customer segments to see variations. This step is valuable even if you don’t do a more formal review.

2. Highlight the top value drivers and those that are the most uncertain and talk to trusted customers to get a gut-check.

3. Conduct market research to nail down the value. There are lots of different approaches that can be taken, but Discrete Choice Modelling (DCM) is the most robust, albeit more costly and time consuming. Again think about customer segments.

4. Consider if you need to change the pricing model to capture more of the value (see next blog).

5. Develop a pricing proposal and test it internally. Create a Value Map to see how the new product fits in to the competitive landscape (including your own products) and help develop the product positioning.

6. Develop your messaging to highlight the strengths while acknowledging and addressing the potential adoption barriers.

7. After launching the product, check-in regularly with sales and with customers to see how it is working out. Create a feedback loop so you can make adjustments.

Summary

Understanding the full value your products and services create for your customers is key to effective pricing. Time and efforts spent understanding this will help you capture a fair share of the value you create. Don’t forget the intangible value!

Any other sources of value you are aware of? Examples of this being done well, or not so well? Leave a comment or get in touch if you would like to discuss.